9 Key Investing Research Questions

How checklists help, the SPAC Boom & yet more Bitcoin...

Checklists: Direction and Clarity

In an age where a number of stocks are pumped on social media (cue the 🚀🚀🚀 emojis), checklists are really important. It’s easy to follow the social media hype and buy into highly-valued stocks without doing much research, but simply having a list or set criteria for what makes a good stock helps provide clarity and direction in your decision making. Below, I'll share 9 key questions I ask when researching potential investments. Do note that these are just key overarching questions and so is not an exhaustive list. Much of the nitty-gritty behind my stock research is not included, but I hope these will be useful for your own research.

How exactly does the business make money?

This is the most important question in my entire research process. I want to be able to understand the company’s entire sales process from customer order to revenue received. A company’s annual report is often the best way to find this out at a glance. A quick read of the ‘Business section’ will provide a picture of what they do, how they define their revenue segments and who their customers are. Here’s an example below using Mastercard’s 2019 Annual Report:

Ideally, from reading the annual report, I am able to put together a snapshot summary of how the company generates revenue. Here’s an idea of what I would write based on the above:

“Mastercard run a global payments network with the aim of ensuring money on transactions is moved quickly and safely. They generate revenue by charging a tiny fee on each transaction made on its network.”

Once I have a clear understanding of how the company generates revenue, I can further research the stock. If I can't understand or explain how a business makes money, more often than not I won’t be interested in researching the company further.

What is the company’s mission?

Consider the below mission statements:

Tesla

“To accelerate the world's transition into sustainable energy.”

And Amazon:

“To be Earth’s most customer-centric company…”

Not only are these statements eye-catching, but they open up a world of possibilities. This is because the services they provide are not mentioned, which itself creates ambiguity and plenty of scope for innovation. When browsing the company’s website or investor reports, I often ask myself: is the company’s mission statement unique? Inspiring? Revolutionary?

What is their financial position?

It’s all well and good if a company has a good product and a management team with great expectations. However, this has to reflect in the financials first. If revenue growth is slow, cash burn is high and debt is heavy, we have a big problem. The below 3 statements help me to determine where a company is at financially, and how they are using money raised or generated through sales:

Income Statement

Balance Sheet

Cash Flow Statement

By tearing into these statements, I can gauge the company’s financial health and earnings potential.

What is their sustainable competitive advantage?

If you read my first newsletter, you may recall the section I wrote on Moats, referring to a company’s sustainable competitive advantage. This allows them to protect or grow their market share.

When researching a stock, I try to define what sets a company apart from their competitors. What is the X factor they have and how strong is it? Moats can come in many forms (E.g. network effects, switching costs, patents). Are they industry leaders in their space, or at least heading fast in that direction? If not, I won’t research any further. Also, while we are here, it’s a good idea to understand who the company’s competitors are.

What is their management and company culture like?

Ideally, I like companies which are led by visionary founders who have an ownership stake in the company. Why? Because they have a special vested interest, having spent years funding and building the company from the ground up. Are they visionaries with an eye towards solving major problems and innovating where possible? How do they allocate capital? Are they customer-centric?

I often think of Jeff Bezos’ response to Amazon’s failed Fire Phone launch in 2016:

“If you think that’s a big failure, we’re working on much bigger failures right now — and I am not kidding… Some of them are going to make the Fire Phone look like a tiny little blip.”

I love that attitude!

What is the industry like?

I believe it’s essential to have an idea of the industry landscape the company operates in. Some questions to consider in this area: what is the Total Addressable Market (TAM) and how much of that does the company believe they can capture? What is key in order for the company to succeed in this industry?

What are the key risks?

There is no such thing as a perfect company, so if there are no risks, it’s likely I’m not researching deep enough. What could potentially stop the investment thesis playing out?

Is valuation reasonable?

As I look towards buying and holding stocks for the long term, valuation is one of the last aspects I consider. I generally aim for a stock to provide 20%+ returns annually over a 3-5 year period. Therefore, I use a few valuation metrics to determine whether I believe a stock can provide these returns. I would rather ‘overpay’ for a quality company, than buy an average company just because valuation seems ‘cheap’. I have learnt this the hard way when deciding not to buy Tesla stock in March 2020!

Can I clearly state why this company will be a good one to invest in?

If I can’t answer this question, it’s likely I’ve fell into one of the below traps:

I haven’t researched the company well enough

I’m borrowing conviction from someone else

I’ve spent time researching company, so I automatically like them

I’m letting price action do the talking rather than the facts

Or, it may just not be a good stock to buy at that moment.

All in all, I like to invest in companies that are making lives easier and solving big problems in a way that is distinctive and efficient. As we know, time is of the essence and the temptation to be led by noise is always near, so these questions help me to stay in check. Developing a systematic research process that works for you will aid your decision making and develop your stock picking abilities.

Sidenote: I would highly recommend the below books which has helped form my thinking in this area:

100 Baggers - Stocks that Return 100-1 and how to find them by Chris Mayer

7 Powers - The Foundations of Business Strategy by Hamilton Helmer

SPACs - Boom (and Bust?)

Special Purpose Acquisition Companies (SPACs) have been growing in popularity in the past year or so. These are essentially ‘blank cheque’ companies, set up to raise capital in order to acquire private companies and take them public. We can see just how increasingly popular they are becoming in the table below:

Source: SPAC Insider

The Initial Public Offering (IPO) count for 2021 is fast approaching 2020’s total and we are only in February! Investors or founders with experience or expertise in a particular industry form a SPAC. Once money is raised, they enter a deal to combine with their target business and trade it publicly. One example of this is the spaceflight company, Virgin Galactic, who entered into an $800m merger with Social Capital’s Chamath Palihapitiya before going public in 2019. Since then, the stock price has appreciated by nearly 400%.

Advantages For Business and Investors

From a business perspective, SPACs are becoming an increasingly attractive method of going public. This is because much of the regulatory and financial hurdles that come with the traditional IPO process are bypassed. By getting to the markets quicker, they have access to cash that can be invested in the business for further growth.

The traditional IPO process often brings about a problem for retail investors: a select group of investors can invest in those companies before the remaining shares are released to the open market at a higher premium. We saw this with the recent Airbnb and Doordash IPOs, where opening valuations were far beyond what was expected.

SPACs allow retail investors the opportunity to invest without fears of a price spike for the above reason. Most SPAC’s are initially priced at $10 a share, so from a dollar perspective they are affordable. Also, investors have the ability to invest in companies who are essentially at an early stage in their life cycle - similar to venture capitalists.

A Word of Caution

As these private companies are generally young, some of them are pre-revenue, meaning they are yet to generate a single dollar in sales. This is where, in a current bull market where every stock seems to go up in price, caution and care should be taken when researching SPACs. I mentioned earlier that SPACs provide private companies with an opportunity to bypass traditional IPO barriers. While this is beneficial, this may result in dozens or hundreds of average, unprofitable, pre-revenue companies flooding into the market. Therefore, the terms of the SPAC deal, the quality of the management teams and the industry itself are important aspects to consider when researching. While they may turn out to be a great investment in the future, there is often a degree of ambiguity when it comes to how money will be invested.

Conclusion

I really like the opportunities the emergence of SPACs has presented for retail investors. Venture capitalists can turn millions into hundreds of millions by investing in companies early - and now retail investors have similar opportunities. The rate at which they are coming to market means investors should be diligent and cautious, considering valuation, management quality and product-market fit.

Market Musings

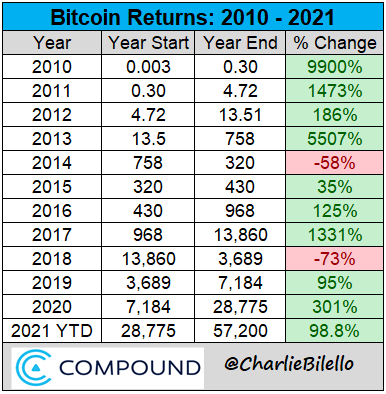

It’s currently earnings season, so it has been a good time to check on how the stocks I own are performing. However, I can’t help but talk about Bitcoin once again (trading at $57k at time of writing). It’s weeks like these where I wish I had allocated a larger chunk of my portfolio to crypto much earlier 😅. Bitcoin’s yearly annual returns have been off the chain:

MicroStrategy, Square and now Tesla have made Bitcoin part of their balance sheet. Which company will be next?